Though the elite top 1% of Global MBA Finance programs have incorporated most subjects areas covered in FFOI's Financial Engineering; the fact remains that almost 99% of B-schools continue to teach nuances of conventional finance. In depth study in areas of risk management, asset class market, even global economics are seldom covered in these programs. Observation is less than 20% of students who do Finance specialization in their MBA get real finance jobs.

FFOI powered MBA (PGDM/MMS) programs means integrating the areas of financial engineering along with conventional MBA curriculum. The training imparted is modular in nature and is spread across 3 semesters with trainers drawn from the industry.

| Financial Org Structure/ Business Models | Global Economics/Macroeconomics , Financial Markets & Instruments( A) | FAS Financial Organisations( IB, HF, FA)( X) | NA | |

| Environment( Economics & Market) | Covered | Covered | Market Environment ( Alpha) | OJT* Plus Thesis Report( F) |

| Financial Skills | Covered | Covered | Financial Analysis( Beta) | Placements.( E) |

| Technology | Covered | NA | Algorithmic Trading & Financial Technology( gamma) | |

| Mathematics & Statistics | Covered | Financial Modelling( Y) | ||

| Asset Class Markets | ACM Analysis & Valuation( Equity -Bond….)(B) | NA | ||

| Risk Management | NA | Introduction to Risk Management (Z) | Advance Risk Management ( Delta) | |

| Capstone Project | Introduction to Financial Engineering ( C)- The Porter Diamonds & explanation of 1-6 | Yes | Yes | |

| Module | A+B+C | X + + Z + Capstone | Alpha plus beta plus gamma plus Capstone | F plus E |

| OJT* is On Job training - Can be done after 2nd sem for MBA students as Internship | ||||

Yes you can, the program grid is mentioned below. In this, FFOI PGPM subjects that are often irrelevant for MBA finance students are eliminated & instead emphasis is purely to develop a domain expert.

| Financial Org Structure/ Business Models | Building Blocks of Business- DMT approach | FAS Financial Organisations (IB, HF, FA) | NA | OJT* Plus Thesis Report( F) |

| Environment( Economics & Market) | Global Economics/Macroeconomics , Financial Markets & Instruments | Economic Environment , Geopolitics & Finan | Market Environment | Placements (E) |

| Financial Skills | Financial Aspects of Business/Finance Management | Advance Financial Management | Financial Analysis | |

| Technology | Tech Tools in Finance | NA | Algorithmic Trading & Financial Technology | |

| Mathematics & Statistics | Fundamentals of Statistics & Mathematics | Financial Modelling | Advance Financial Modelling | |

| Asset Class Markets | NA | ACM Analysis & Valuation( Equity -Bond….)P | NA | |

| Risk Management | NA | Introduction to Risk Management | Advance Risk Management | |

| Capstone Project | Yes | Yes | Yes | |

| OJT* is On Job training - Can be done after 2nd Sem for MBA students as Internship | ||||

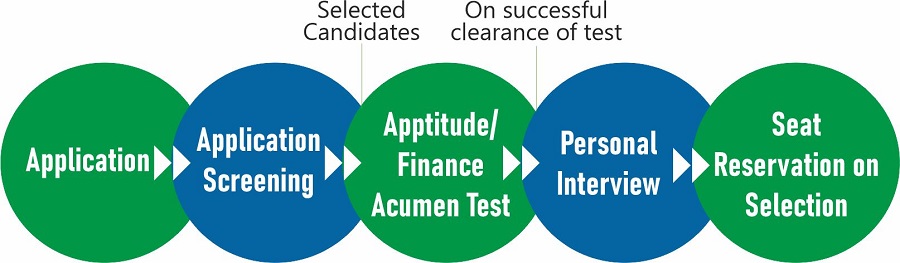

Financial Acumen Assessment is an assessment tool to check the readiness of a student to study the program. In simple words it acts as tool to screen students & even a tool for availing FFOI scholarships.