Imagine you have a small garden. You've planted different types of plants: vegetables, flowers, and herbs. Some plants thrive in the sun, while others need shade. You periodically check on them, remove weeds, water them, and maybe even decide to plant new seeds or remove some plants. This ongoing process of evaluating and managing your garden is similar to how you should manage your investment portfolio. In the financial world, a portfolio is a collection of various investments like stocks, bonds, real estate, and other assets. Evaluating and making decisions about your portfolio is crucial for achieving your financial goals and managing risks. Let’s dive into the steps and considerations involved in effectively evaluating your portfolio and making informed investment decisions.

First you need to mention different asset class – their Characteristics and evaluation criteria

Before evaluating your portfolio, it’s essential to have a clear understanding of your financial goals. Are you putting money aside for retirement, a down payment on a home, or your child's education? Your goals will influence your investment strategy. For instance, if you’re saving for retirement in 30 years, you might be more willing to take risks compared to saving for a house you want to buy in five years.

Example

Rani is 35 years old and wants to retire by 60. She aims to accumulate a substantial retirement fund over the next 25 years. This long-term goal allows her to invest more in stocks, which are riskier but have the potential for higher returns.

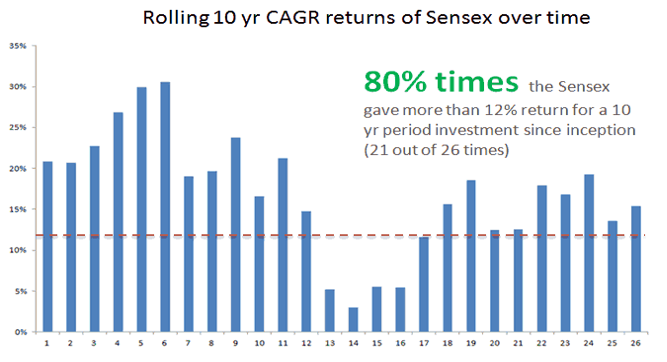

To evaluate your portfolio, start by reviewing its current performance. This involves looking at the returns generated by your investments over a specific period and comparing them to relevant benchmarks. A benchmark could be an index like the S&P 500 for stocks or a bond index for fixed-income securities.

Total Return:

The overall return on your portfolio, including dividends, interest, and capital gains.

Risk-Adjusted Return:

Measures the return relative to the risk taken, often assessed using the Sharpe Ratio.

Diversification:

Evaluates whether your portfolio is spread across various asset classes and sectors to minimize risk.

Example

John Portfolio has a total return of 8% over the past year. He compares this to the S&P 500, which returned 10% over the same period. This indicates that John’s portfolio underperformed the market.

Asset allocation is the process of dividing your portfolio among different asset categories, such as stocks, bonds, and cash. The appropriate blend depends on your risk appetite, financial objectives, and investment timeline.

Determine Your Risk Tolerance:

Assess your willingness and ability to take risks.

Evaluate Current Allocation:

Review the percentage of your portfolio in each asset class.

Rebalance as Needed:

Adjust your portfolio to align with your target allocation.

Example

Emily has a moderate risk tolerance and wants 60% of her portfolio in stocks and 40% in bonds. Currently, her portfolio has 70% in stocks due to market growth. She decides to sell some stocks and buy bonds to return to her desired allocation.

Assessing each investment in your portfolio is critical. This involves looking at the performance, risk, and future prospects of each asset. criteria for Evaluation:

Performance History: Review historical returns.

Financial Health: Analyse financial statements for stocks or bond ratings.

Market Position: Consider the competitive position and market conditions.

Future Prospects: Evaluate growth potential and economic outlook.

Example:

David has invested in a tech stock that has performed well over the past three years. However, upon reviewing the company's latest financial reports, he notices a decline in revenue and increasing debt. He decides to sell the stock and invest in a company with stronger financial health and growth prospects.

Risk management is a vital part of portfolio evaluation. Different types of risks include market risk, interest rate risk, inflation risk, and credit risk. Diversification is a key strategy to manage risk, as it reduces the impact of poor performance in any single investment.

Diversification:

Spread investments across different asset classes and sectors.

Hedging:

Use financial instruments like options and futures to mitigate risk.

Regular Review:

Periodically review and adjust your portfolio to address changing market conditions and personal circumstances.

Example

Lisa's portfolio is heavily invested in energy stocks. To manage sector-specific risk, she diversifies by adding investments in technology, healthcare, and consumer goods.

After evaluating your portfolio, making informed decisions is crucial for optimizing performance and achieving your financial goals. Consider the following when making investment decisions:

Fundamental Analysis:

Assess a company’s financial stability, financial health, and market standing.

Technical Analysis:

Analyse statistical trends from trading activity, such as price movement and volume.

Economic Indicators:

Consider macroeconomic factors like interest rates, inflation, and economic growth.

Growth Investing:

Concentrate on companies with strong prospects for future expansion.

Value Investing:

Look for undervalued companies that are trading for less than their intrinsic value.

Income Investing:

Invest in assets that provide regular income, such as dividends or interest.

Example

Mike uses a combination of fundamental and technical analysis to identify a tech company with strong financials, a competitive edge, and positive market trends. He decides to invest, expecting significant growth over the next few years.

Evaluating your portfolio and making informed investment decisions is an ongoing process. By understanding your financial goals, assessing performance, analysing asset allocation, evaluating individual investments, and managing risk, you can create a robust investment strategy. Just like tending to a garden, regular attention and adjustments will help your portfolio flourish and achieve your financial objectives.