In the realm of corporate finance, debentures and bonds are critical instruments that companies often consider raising capital. These financial tools provide an avenue for businesses to access funding beyond traditional bank loans or equity financing. This blog explores what is debentures/bonds, their types, when corporates should consider issuing debentures or bonds, the differences between them, the pros and cons, and the risk associated with them.

Debentures:

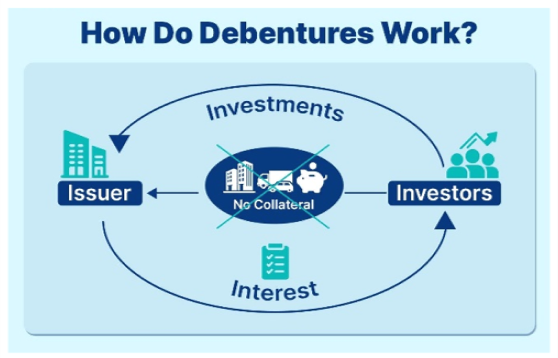

Debentures are debt instruments issued by corporations to raise capital. When a company issues debentures, it essentially borrows money from investors who purchase these instruments. In return, the company promises to repay the principal amount at maturity and pay periodic interest payments (coupons) to debenture holders.

Bonds:

Bonds are like debentures but often refer to debt securities issued by governments or corporations. They have fixed interest rates and maturity dates, just like debentures. Bonds can be issued for various purposes, including financing infrastructure projects, refinancing debt, or funding general operations.

Secured Debentures/Bonds:

These are backed by specific assets of the company, providing security to investors in case of default.

Unsecured Debentures/Bonds:

Often referred to as debentures, these are not backed by any specific assets, relying solely on the issuer’s creditworthiness.

Convertible Debentures/Bonds:

They can be converted into equity shares of the issuing company after a certain period.

Non-Convertible Debentures/Bonds:

These debentures/bonds cannot be converted into equity and remain purely as debt instruments until maturity.

Callable Bonds:

They can be redeemed by the issuer before the maturity date, usually at a premium.

Putable Bonds:

Such bonds allow investors to sell the bond back to the issuer before maturity, usually at face value.

Expansion and Growth:

Corporates often consider issuing debentures or bonds when they need substantial funds for expansion projects or growth initiatives. These instruments provide access to large amounts of capital that can support investments in new facilities, technology upgrades, or market expansion strategies.

Lower Cost of Capital:

Debentures and bonds can sometimes offer a lower cost of capital compared to other forms of financing, such as bank loans or equity. This is especially true when interest rates are favorable or when a company's credit rating allows it to access debt markets at competitive rates.

Diversification of Capital Structure:

Issuing debentures or bonds helps diversify a company's capital structure by adding debt alongside equity financing. This diversification can improve financial flexibility and reduce reliance on any single source of funding, enhancing overall risk management.

Long-Term Financing:

For projects or investments that require long-term financing, such as infrastructure development or research and development initiatives, debentures and bonds provide an attractive option. The maturity periods of these instruments can range from several years to decades, aligning well with long-term financial needs.

Refinancing Existing Debt:

Companies may issue new debentures or bonds to refinance existing debt with higher interest rates or approaching maturity. This refinancing can lower interest expenses, extend debt maturity profiles, and improve overall financial stability.

Example:

XYZ Corporation, a technology firm, plans to build a new state-of-the-art research facility to develop cutting-edge products. To finance this project, XYZ decides to issue bonds with 10-year maturity. By doing so, XYZ secures the necessary funds upfront while spreading repayment over a long period, aligning with the project's timeline and financial needs.

While debentures and bonds are both debt instruments, there are distinctions based on their characteristics and usage:

Security Debentures:

Typically unsecured, meaning they are not backed by specific assets of the company. Debenture holders rely on the general creditworthiness of the issuer. Bonds: Can be either secured (backed by specific assets) or unsecured. Secured bonds provide additional security to investors by collateralizing company assets.

Issuer Type Debentures:

Primarily issued by corporations, although governments and other entities can also issue debentures. Bonds: Issued by governments (government bonds) or corporations (corporate bonds).

Term Debentures:

Often used interchangeably with bonds but can imply longer-term debt instruments. Bonds: Generally refers to debt securities with specific terms and conditions, including maturity dates and interest rates.

Market Perception Debentures:

Perceived as higher risk due to their unsecured nature. Investors assess the creditworthiness of the issuer carefully Bonds: Can vary in risk depending on whether they are secured or unsecured, but generally seen as safer investments than debentures if backed by assets.

Pros of Debentures:

Access to Capital:

Debentures allow companies to raise significant amounts of capital, providing flexibility for growth and expansion.

Lower Cost of Financing:

When interest rates are favorable or when a company has a strong credit rating, debentures can offer lower borrowing costs compared to equity financing.

Diversification of Funding Sources:

Issuing debentures diversifies a company's sources of funding, reducing reliance on bank loans or equity investors.

Cons of Debentures::

Interest Payments:

Regular interest payments (coupons) are obligations that companies must meet, regardless of their financial performance or profitability.

Risk of Default:

Unsecured debentures carry a higher risk of default compared to secured debt instruments. Investors may demand higher interest rates to compensate for this risk.

Impact on Credit Rating:

High levels of debt from debenture issuance can affect a company's credit rating, potentially increasing future borrowing costs.

Example:

ABC Corporation issues debentures to finance a major acquisition. While the debentures provide immediate funding, the company faces higher interest expenses over time, impacting profitability and financial flexibility.

Debt Repayment Obligations:

Failure to meet interest or principal payments can lead to default, damaging the company’s credit rating and financial stability.

Interest Rate Risk:

If interest rates rise after the bonds are issued, the company could face higher borrowing costs when refinancing.

Market Conditions:

Adverse market conditions can affect the pricing and demand for corporate bonds, potentially leading to higher yields (and thus higher interest costs) required by investors.

Credit Risk:

The company's ability to maintain a good credit rating is crucial. Downgrades can increase borrowing costs and limit access to future debt markets.

Covenant Restrictions:

Bonds often come with covenants that restrict the company’s activities, such as limits on additional borrowing, dividend payments, or asset sales. These can constrain managerial flexibility.

Debentures and bonds are valuable tools for corporates seeking to raise capital for various purposes, from expansion projects to refinancing existing debt. Understanding when to consider issuing these instruments, their differences, and the pros and cons associated with debentures is essential for making informed financial decisions.

By leveraging debentures effectively, companies can access capital markets, diversify funding sources, and manage their capital structures strategically. However, it's crucial to weigh the benefits against potential risks, such as interest obligations and credit implications, to ensure sustainable financial health and growth.